Exit Strategy Planning

If you are planning to sell your business, it’s a great idea to set a base line value for the business and develop a strategy to improve the profitability to increase the value as an exit strategy.

How much is your business worth? This is not a speculative question, or one that should be answered with a “ballpark” guess. Attaching an accurate valuation to a company is a critical part of ongoing business strategy.

There are two general approaches to the valuation of a business – the liquidation approach and the going concern approach. Given the ongoing nature of the businesses concerned, we will focus solely on undertaking a valuation based on a going concern approach.

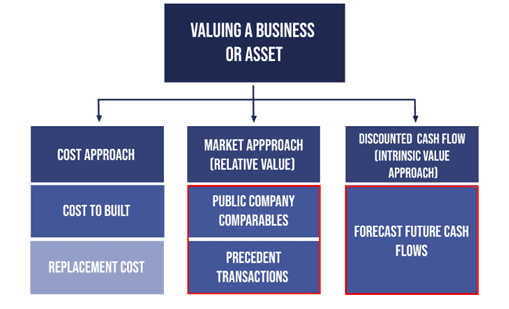

When valuing a company as a going concern, there are three main valuation methods used:

The cost approach looks at what it costs to build something and this method is not frequently used to value a company as a going concern. Accordingly, this is seldom used to as a valuation approach.

The market approach is a form of relative valuation and frequently used in the industry. It includes Comparable Analysis Precedent Transactions.

The Discounted Cash Flow (DCF) approach is a form of intrinsic valuation and is the most detailed and thorough approach to valuation modelling.

Comparable company analysis (also called “trading multiples” or “peer group analysis” or “equity comps” or “public market multiples”) is a relative valuation method in which we compare the current value of a business to other similar businesses by looking at trading multiples like P/E, EV/EBITDA, or other ratios. Multiples of EBITDA are the most common valuation method.

This method provides an observable value for the business, based on what companies are currently worth. Comps are the most widely used approach, as they are easy to calculate and always current. The logic follows that, if company X trades at a 10-times P/E ratio, and company Y has earnings of £2.50 per share, company Y’s stock must be worth £25.00 per share (assuming its perfectly comparable).

One factor that needs to be carefully considered when applying this approach is determining the true underlying profitability of the company – its ‘normalised’ earnings.

For Private Companies, the comps valuation method can still be used, with an appropriate discount factor to reflect the relative illiquidity in the company’s shares. This discount is typically between 30 and 40%

Precedent transactions analysis is another form of relative valuation where you compare the company in question to other businesses that have recently been sold or acquired in the same industry. These transaction values include the takeover premium included in the price for which they were acquired.

These values represent the realised value of a business achieved in a transaction. They are useful for M&A transactions, but can easily become stale-dated and no longer reflective of the current market as time passes. They are less commonly used than Comps or market trading multiples.

Discounted Cash Flow (DCF) analysis is an intrinsic value approach where an analyst forecasts the business’ unlevered free cash flow into the future and discounts it back to today at the firm’s Weighted Average Cost of Capital (WACC).

A DCF analysis is performed by building a financial model in Excel and requires an extensive amount of detail and analysis. It is the most detailed of the three approaches, requires the most assumptions, and often produces the highest value. However, the effort required for preparing a DCF model will also often result in the most accurate valuation. A DCF model allows the analyst to forecast value based on different scenarios and even perform a sensitivity analysis.

For larger businesses, the DCF value is commonly a sum-of-the-parts analysis, where different business units are modelled individually and added together.

Given the context and background to the requirement for an intendent third party valuation, we would prepare a formal report our results for all shareholders in the event of a sale or a roll up of the companies and/or redistribution of shares.

Included in this report will be a summary of the financial information received and analysed, the different valuation methods applied and their results. We would present these results through a ‘football field chart’ to summarize the range of values for the business based on the different valuation methods used. Below is an example of a football field analysis/graph.

This graph summarizes the company’s 52-week trading range (its stock price, assuming it’s public), the range of prices analysts have for the stock, the range of values from comparable valuation modelling, the range from precedent transaction analysis, and finally the DCF valuation method. The orange dotted line in the middle represents the average valuation from all the methods.